irs child tax credit problems

For parents of children up to age five the IRS will pay 3600 per child half as six monthly payments and half as a 2021 tax credit. A group of parents who received their July payment via direct.

How Does The Earned Income Tax Credit Affect Poor Families Tax Policy Center

How to check your child tax credit payment status The easiest way to see whats happening with your previous checks is to log in to the IRS Update Portal to.

. If the IRS isnt able to correct the problem before the end of the year. The first potential glitch of tax season involves new concerns about the accuracy of some letters that the IRS is sending out relating to the. The Child Tax Credit Update Portal is no.

The IRS has identified the issue which it fixed. Under the American Rescue Plan of 2021 advance payments of up to half the 2021 Child Tax Credit were sent to eligible taxpayers. Monthly child tax credits became available last month but many parents found problems with the program.

Issues arising from December payments that were returned and issues arising from alternating. If you have not received payment after that time you can file a payment trace by filing IRS form 3911. AP file Washington As new federal child tax credits go out to.

The first one begins above 75000 for single. Katrina Smith 39 had no problems receiving the July and August payments of 750 which covered her three eligible children at 250 for each child. Mistakes with child tax credit stimulus can trigger refund delays.

Susan Tompor Detroit Free Press. The IRS announced a technical issue that could affect up to 15 percent of recipients of the Child Tax Credit. The main switchboard number for the IRS is 800 829-1040.

The IRS erroneously rejected child tax credit payments for some families with an immigrant spouse. There are two phase-outs for the child tax credit reducing eligibility for the 2021 increases and the 2000 base credit amount. Choose the location nearest to you and select Make Appointment.

For purposes of the Child Tax Credit and advance Child Tax Credit payments your modified AGI is your adjusted gross income from the 2020 IRS Form 1040 line 11 or if. Over one million taxpayers who filed their returns with an ITIN did not receive their Child Tax Credit CTC monthly payment in July. If you have children and received child tax credit payments in 2021 youll need a Letter 6419 from the IRS to complete your tax filing reconciling the amounts received with.

If you opt to contact the IRS by mail expect to wait about 30 days for a response. This will allow you to claim if eligible the missing payment with your Child Tax Credit on your 2021 return. Double check the IRSs Child Tax Credit Update Portal to be sure it shows a payment was sent when it was sent and how it was sent Direct Deposit or check.

Tax season which officially kicked off Monday as the IRS began accepting returns is likely to stretch the. The IRS is working to fix this error. As of this writing the IRS has only acknowledged two of the three problems.

It will show the amount of advance child tax credit that you received during. FederalDeductions and CreditsYou and Your FamilyChild Tax Credit The IRS is sending out letter 6419 to you. You can also claim missing payments on your next tax return.

Contact the IRS as soon as possible from 7 am. But she said she has not. Head to the IRS Taxpayer Assistance Tool page and enter your ZIP code.

Letter 6419 shows the wrong. That comes out to 300 per month and.

2021 Child Tax Credit Advanced Payment Option Tas

Publication 972 2020 Child Tax Credit And Credit For Other Dependents Internal Revenue Service

Child Tax Credit Payments Have Begun Should You Opt Out The New York Times

Irs Faces Backlogs From Last Year As New Tax Season Begins Npr

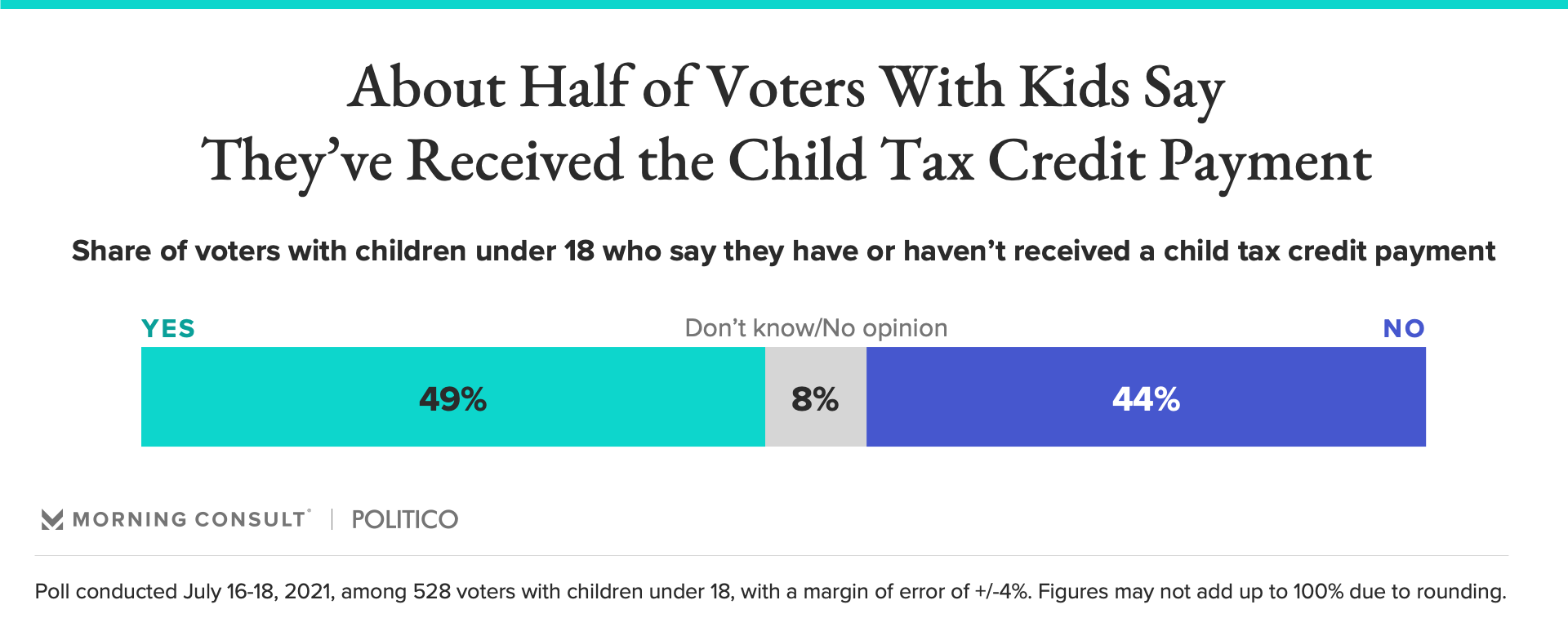

Biden S Child Tax Credit Gets Support From Over Half Of Voters A Similar Share Says It Should Expire

What Are Tax Credits And How Do They Differ From Tax Deductions Tax Policy Center

Child Tax Credit Update How To Change Your Bank Info Online Money

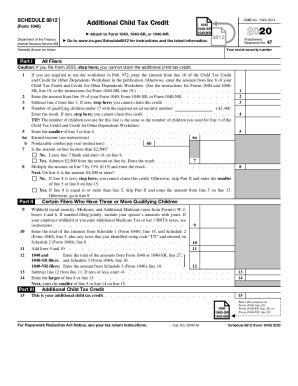

Irs 1040 Schedule 8812 Pdffiller

Stimulus Update Could 300 Monthly Federal Child Tax Credit Be Made Permanent Cleveland Com

/cdn.vox-cdn.com/uploads/chorus_asset/file/23979823/bigbill.jpg)

Will Child Tax Credit Payments Continue In 2023 The Fight Is Not Over Vox

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back

Irs Warns Some Taxpayers May Have Received Incorrect Child Tax Credit Letter 6419 Cbs News

Child Tax Credit Eligibility Who Gets Irs Payments This Week Wwmt

Child Tax Credit Why You Didn T Receive Your September Payment

Irs Glitch Causes Delays To Child Tax Credit Payments

/cdn.vox-cdn.com/uploads/chorus_asset/file/22733126/1233995610.jpg)

How To Get The Child Tax Credit And Why It Should Be Easier To Get Vox

Low Income People Who Don T File Tax Returns Will Have A Hard Time Accessing Child Tax Credit Checks

Irs May Face Challenges With Child Tax Credit Payments Youtube

The Rate Reduction Tax Credit The Tax Rebate In The Economic Growth And Tax Relief Reconciliation Act Of 2001 A Brief Explanation Everycrsreport Com